E-Commerce Statistics and Benchmarks

- E-commerce has advanced 5 years due to the pandemic

Stay at home rules have accelerated online purchases by over 20% during 2020 according to a study by IBM.

- Worldwide, e-commerce share has grown year over year and is on track to beat in store retail by about four times

- Retail still is much larger than e-commerce surpassing it by $21 trillion

- North America and Western Europe are the slowest growing e-commerce regions. APAC, Latin America, and the Middle East & Africa growing the fastest.

- E-commerce share of global retail doubled in four years, growing from 7.4% in 2015 to 14.1% in 2019. And is on track to 20% by 2022.

Ecommerce and retail each have their strengths, and technology brings out the best in both. This partnership creates a strong, personalized customer experience to aid global business growth. (Data source: eMarketer)

Device Split (Desktop vs. Mobile Web)

- Top 100 websites in the category:

- Desktop – 48.76% (vs. 45.84% in 2019)

- Mobile Web – 51.24% (vs. 54.16% in 2019)

Traffic Acquisition Sources (By Marketing Channel)

Direct (54%) is the main source of web traffic to eCommerce sites, followed by organic search (29%)*. This is proof of the important role brand recognition plays in consumers’ purchase decision process.

- Direct – 54.27% (vs. 54.88% in 2019)

- Email – 2.36% (vs. 2.68% in 2019)

- Referrals – 5.73% (vs. 5.36% in 2019)

- Social Media – 3.76% (vs. 3.84% in 2019)

- Organic Search – 28.87% (vs. 26.46% in 2019)

- Paid Search – 4.03% (vs. 5.30% in 2019)

- Display Advertising – 0.98% (vs. 1.48% in 2019)

Free Traffic vs. Paid Traffic

Free traffic refers to organic search, direct, email, and social media; paid traffic refers to referrals, paid search (PPC/SEM), and display advertising.

- Free Traffic – 89.26% (vs. 87.86% in 2019)

- Paid Traffic – 10.74% (vs.12.14% in 2019)

Conversion benchmarks by the retail sector

Conversion Rate by Traffic Source

This research from Episerver retail clients Q1 2020 (based on 1.3 billion unique shopping sessions across 159 unique retail and consumer brand websites) shows a typical pattern. Conversion rates are significantly higher where consumers have higher intent, i.e. they are searching for products. This compares to social and displays referred visits where conversion rates are significantly lower.

eCommerce Websites’ Percent of PPC Search Traffic

14.66%

Stickiness

On average, a returning or ‘sticky’ visitor is 70% more likely to add a product to their cart than a new visitor.

- Top 100 websites in the category:

- Unique Visitors / Total Visits – 28.57% (vs.30.02% in 2019)

Speed

Your visitors’ on-site experience and satisfaction play a crucial role in determining whether they will continue to browse and shop in your store.

Does your site load quickly?

Decreasing your website’s load time by just 0.1 seconds can increase conversion rates by up to 8%.

Are users spending a long time on your site? Is a large percentage of visitors leaving after viewing just one page? (Also known as Bounce Rate).

- Average visit duration – 3m 56s (vs. 6m 47s in 2019)

- Average pages per visit – 5.6 (vs. 8.1 in 2019)

- Average bounce rate – 47.28% (vs. 37.36% in 2019)

For eCommerce websites, the average CVR is 4.6% (as of May 2020)

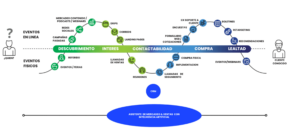

E-commerce conversion funnel

This funnel-based view of the conversion process is useful since as well as the average basket and sales conversion rates, it also shows the conversion rates to product page views which aren’t published so often:

Conversion benchmarks by the retail sector

This recent update is from the Adobe Digital Index 2020 report into consumer electronics that compares conversion to these other sectors.

Lead generation and landing page conversion rates by sector

This landing page lead generation conversion rate research from Unbounce reports lead conversion rates by industry. Industries covered include business-to-business, Travel, Healthcare, Legal, and Education sectors.

Mobile retail conversion rates

The average conversion rate by sector for Desktop vs Mobile vs Tablet is reported by Zukio performance benchmarks in August 2020. Overall we can see a higher rate of conversion on Desktop with an average of 47%. Mobile and Tablet conversion rates are similar but slightly lower than desktop conversion rates, suggesting people are increasingly comfortable with the experience of buying on tablets.

Form completion conversion rate comparison

Another source to use for benchmarking lead generation efficiency which has unique insight breaking down the process by sector is provided by the Zuko form performance benchmarks August 2020.

Form types include purchase, inquiry, and registration and most we track are transactional forms of various kinds, but you can see the breakdown in those reports too

This report from the Comscore Global Mobile Payments report has a simple table breaking down the share of time spent online. It shows that the share of mobile spending grew in 2019 all continents below except for a 1% fluctuation in Latin America.

Omnichannel conversion rates – Research-online purchase-in-store

Compilations of published conversion rates often only consider online conversion to sale. New research by Google and Wolfgang Digital shines a light on ‘research-online purchase-in-store’.

“By uploading Point Of Sale information to Google, retailers can now match in-store purchasers with online ad clickers, gaining further visibility on the success of their campaigns.”

Digital marketers saw an extra 168% in revenue in their in-store sales, on top of what was made online.

See more data on our Sell More blog click here

Want to gain an edge? See our leading-edge Sales Technology platforms here:

impaKt.tech Lead generator and sales expediting platform with AI

Sales Training Platform 15% to 30% revenue increase in 90 days or less

Omnichannel Platform – listen and attend to your customers wherever they are

These statistics brought to you by impaKt.tech®

3 Enterprise Level Sales Technology Services to propel revenue:

impaKt.Tech®

US +1 (786) 475-7696

[email protected]

Set up a call with us here

Data sources:

Adobe Retail Report

ComScore

eMarketer

Episerver

Google and Wolfgang Digital

IBM State of Retail Report

Copyright impaKt.tech